My Favorite Combo and Tips

I’ve always loved to travel, but let’s be honest: it’s not cheap! Flights, hotels, meals on the road—it all adds up quickly. For the longest time, I thought traveling frequently meant spending a fortune. But over the years, I’ve learned one simple trick that has allowed me to travel far more than I ever thought possible—travel credit cards.

Now, I’m not saying credit cards are a magic fix, but when used wisely, they can transform how you pay for trips and make even the most expensive travel experiences much more affordable. In fact, a few smart moves with the right travel cards can unlock free flights, hotel stays, and plenty of other perks. Here’s how I use credit cards to maximize my travel budget and how you can do the same.

How Travel Credit Cards Work for Me

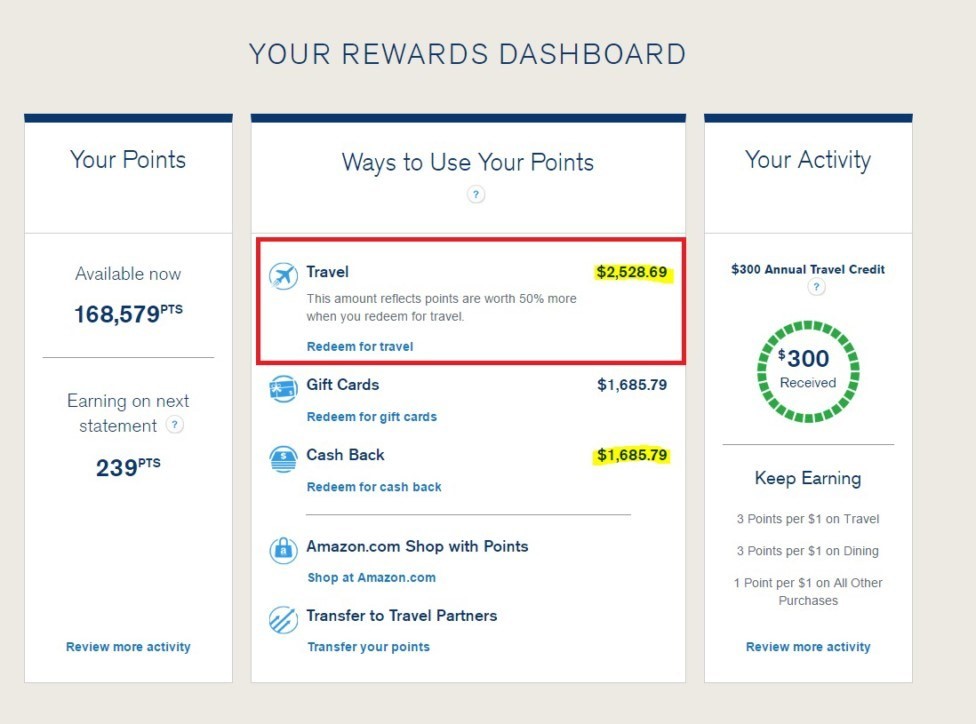

The first time I booked a nearly free flight using credit card points, I was hooked. The way most travel credit cards work is pretty simple: you earn points or miles on everyday purchases, and then redeem them for travel-related expenses like flights, hotels, or car rentals. Some cards even offer bonuses for certain categories like dining, groceries, or (my favorite) travel.

For example, I love using my Chase Sapphire Preferred® Card because it gives me 2x points on travel and dining (both things I spend a lot on while on the road), and 1x on everything else. When I redeem these points through Chase’s travel portal, they’re worth 25% more, which has saved me a ton on flights and hotels over the years.

But the real magic happens when you start combining cards to make sure you’re earning the most rewards for every dollar you spend.

My Favorite Travel Credit Card Combos

I’ve found that the best way to maximize rewards is to use multiple credit cards that complement each other. Here are a few combos that I swear by:

The Ultimate All-Rounder Combo

- Chase Sapphire Preferred®: This is my go-to for travel and dining. The points are super flexible, and I can transfer them to different airline and hotel partners, making them more valuable.

- Chase Freedom Flex℠: This card earns 5x points on rotating categories (like gas, groceries, or even travel), which helps me rack up points on everyday purchases. Plus, it has no annual fee, so it’s all about earning more without spending more.

- World of Hyatt Credit Card: If you’re someone like me who loves hotel stays with a bit of luxury on a budget, this card gives me 4x points on Hyatt stays and perks like free nights and elite status.

Together, these cards give me solid rewards for all of my travel-related purchases without me having to overthink it.

The Budget Traveler Combo (No Annual Fees)

Not everyone wants to pay annual fees, and I totally get that. For budget travelers, I recommend:

- Capital One VentureOne Rewards: It earns 1.25x miles on everything, and the miles are super easy to use on any travel purchase.

- Bank of America® Travel Rewards: This one gives me 1.5x points on every dollar I spend, with no foreign transaction fees and no annual fee.

Even without paying annual fees, these cards still let me earn travel rewards, and trust me, they add up!

How I Maximize Travel Credit Card Rewards

Having a great travel credit card is one thing, but you also need a plan to get the most out of it. Here are a few tricks I’ve learned over the years:

- Use Your Card for Everyday Expenses: This might sound obvious, but I use my cards for everything—groceries, gas, dining out, and online shopping. It’s all about maximizing rewards on things you’d already be paying for. For example, my Chase Sapphire Preferred® gives me points every time I dine out, which is a big win when traveling.

- Double Dip with Loyalty Programs: I always sign up for hotel and airline loyalty programs and use my travel cards to book through them. That way, I earn points from both the credit card and the loyalty program—a win-win!

- Pay Off Your Balance: This is key! This strategy only works if you’re not paying interest. I make sure to pay off my credit card balance every month, so I’m earning all the rewards without any debt.

Travel Credit Card Perks I Can’t Live Without

Besides points and miles, travel credit cards come with a lot of extra perks that can save you a ton of money while traveling. Here are a few that I’ve used (and loved):

- Free Checked Bags: If you fly often, you know how quickly baggage fees can add up. Cards like the Delta SkyMiles® Gold American Express Card offer free checked bags for you and even your travel companions.

- Airport Lounge Access: I used to think lounge access was only for people flying first class, but cards like the Chase Sapphire Reserve® and the Amex Platinum Card give me access to Priority Pass lounges. It’s been a lifesaver during long layovers!

- No Foreign Transaction Fees: One of my pet peeves is paying extra just because I’m spending money in a different country. That’s why I only use travel credit cards with no foreign transaction fees. Cards like the Capital One VentureOne and Chase Sapphire Preferred® make sure I’m not getting hit with extra charges while abroad.

Traveling Wisely Using Credit Cards

While travel rewards are awesome, travel wisely’s just as important. Here’s how I stay organized and avoid any credit card pitfalls:

- Track Spending: I use apps like Trail Wallet to track my travel expenses and see how much I save with rewards. It’s super helpful for staying within budget while I’m on the road.

- Plan Ahead: I always plan trips around my points. If I know I want to go somewhere, I focus on earning the points or miles needed for that specific trip. Tools like Google Flights help me track airfare prices, and once I see a good deal, I use my credit card rewards to book it for even less.

My Favorite Budget Travel Credit Cards

For those of you looking for great travel credit cards without the hefty fees, these are my top picks:

- Bank of America® Travel Rewards: It has no annual fee, and I get 1.5x points on every dollar I spend. Redeeming points for travel expenses is super simple and flexible.

- Discover it® Miles: They match all the miles I earn in the first year, making it perfect for travelers who don’t want an annual fee but still want great rewards.

- Capital One VentureOne Rewards: Another no-fee card that gives me 1.25x miles on every purchase. It’s great for travelers who want something straightforward.

Until next time,

Susan

Travel More, Spend Less

In the end, using the right travel credit card has completely changed the way I travel. I’ve been able to cut down on costs, stay in nicer hotels, and enjoy extra perks that I wouldn’t have thought were possible without breaking the bank. Whether you’re a frequent flyer or just planning a yearly getaway, there’s a card (or combination of cards) that can help you travel more and spend less. Just remember to use them wisely, pay off your balances, and take full advantage of all the rewards and perks they offer.

So, what are you waiting for? Start planning your next trip with the help of a great travel credit card, and watch your travel dreams come to life without the massive price tag!